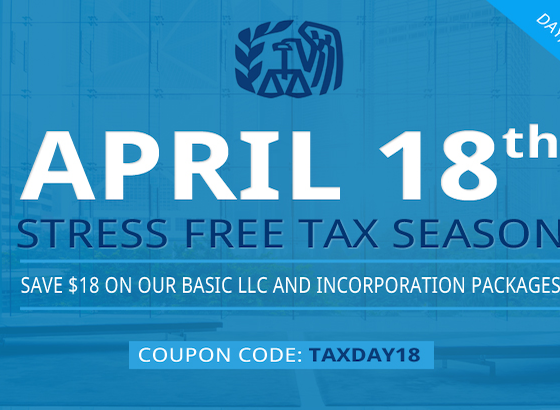

Tax returns are offically due April 18th – unless you filed an extension, or live in Maine or Massuchessetts – and in honor of the end of tax season, and to hopefully take away some of the stress that comes with paying taxes, MyCorporation is offering $18 off either our basic LLC or Incorporation package on April 18th. Just use coupon code TAXDAY18 when you checkout!

And for those of you who filed early and have nothing to stress about (and those of you who are looking for a way to procrastinate before filing your returns), we also compiled 18 Tax Facts in honor of the looming April 18th deadline:

- In 2014, the IRS collected over $3.1 trillion in federal revenue, and issued 118.7 million refunds amounting to $330 billion back to individual filers.

- 363,481 of the refunds for 2014 were issued to corporations.

- “Pass-through” businesses are on the rise; the number of filing S-Corporations grew 660 percent from 1980 to 2011, when over 4.15 million S-Corps filed their returns. In contast, the number of C Corporations filing returns declined from 2.2 million in 1980, down to 1.6 million in 2011.

- Over 2.2 million “C” and other, non-pass through corporations filed returns in 2014, from which the IRS collected over $352 billion before refunds.

- 11.5% of 2014’s gross collections were from business income taxes.

- IRS.gov received over 437 Million visitors during the 2014 fiscal year.

- Around 65% of all returns are filed electronically.

- Individual filers vastly prefer e-filing to paper, with 84% of all individual payers filing electronically, while only 53% of corporate returns were e-filed.

- 28 million returns were filed by California business and citizens in 2014; more than any other state!

- California also had the most C-Corporation filings at 317,637. Florida, meanwhile, boasted the most S-Corp filings at 608,236.

- Many experts believe home offices are a major trigger for an IRS Audit, but the IRS introduced a much simpler, more stream-lined option in 2013 that should lower the risk of mistakes.

- Tax exempt and non-profit organizations have to file a return every year too, and over 1.4 million did so in 2014.

- A little over 62% of all the individual e-filed returns for 2014 done by a paid preparer.

- The IRS’s automated underreporter program, which matches individual tax returns with documents filed by employers, resolved 3.8 million discrepancies and assessed over $5.9 Billion extra in 2014.

- 71% of 2014’s audits were done via postal correspondence, with the remaining 29% conducted in field.

- Fewer than 1% of all returns are audited but, if they are, there is only a 3% chance the IRS will find additional refund.

- Corporate returns are the most likely to be audited; the IRS examined 1.3% of all corporate returns, not including S-Corps, in 2014.

- The IRS will never call to demand immediate payment, nor will they call you without first mailing a bill for the amount owed.

Sources: