What does the state of small business look like in 2020? Guidant Financial partnered with online lending marketplace LendingClub to uncover the answers in their annual State of Small Business survey. This is the 2020 Small Business Trends Report.

2020 Small Business Trends Report

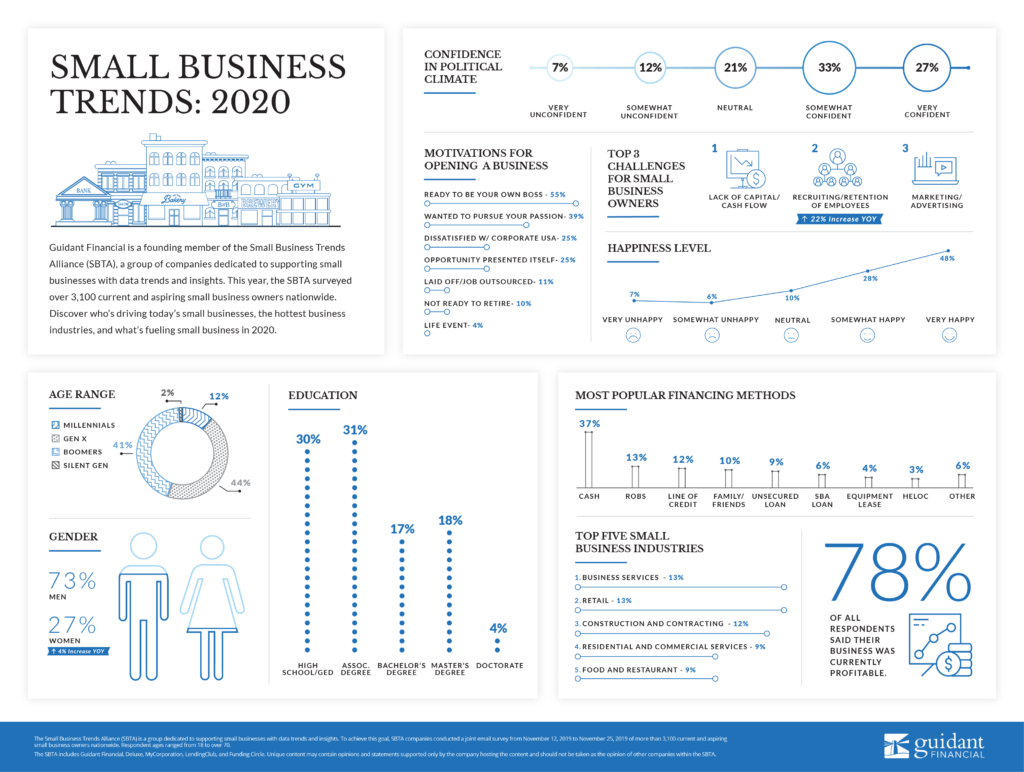

Over 3,000 current and aspiring business owners were surveyed nationwide in the 2020 Small Business Trends report. Results from the survey take a closer look at current small business trends. Some of these include, but are not limited to, the following elements of entrepreneurship.

- Top business industries. From restaurants to retail, entrepreneurs reveal the top five industries they’re starting a business in.

- Most popular financing methods. How are small businesses receiving the funding they need to succeed? 2020 Small Business Trends takes a deep dive into financing methods, like cash and SBA loans, that are most popular with entrepreneurs.

- Top business challenges. In addition to uncovering small business challenges, 2020 Small Business Trends explores an entrepreneur’s average happiness level.

- Motivations for opening a business. Why are so many business owners pursuing entrepreneurship? 2020 Small Business Trends examines why individuals are becoming entrepreneurs, with reasons ranging from being your own boss to following your dreams.

- And much more insight!

Check out the infographic below to learn more about the 2020 Small Business Trends!

Ready to start and incorporate a small business?

MyCorporation is here to help turn your small business dream into a thriving reality. If you’re ready to start a business, our team of professionals is here to help you each step of the way.

Check out a few of our offerings that every entrepreneur needs to check off their compliance to-do list.

- Incorporate or form an LLC. Incorporating your business provides liability protection. This separates your personal and professional assets, plus business structures provide small business owners with tax savings and establishes credibility.

- File for an Employer Identification Number. Filing for an EIN provides your small business with a federal tax ID that may be used in lieu of a social security number (SSN) on business paperwork. You may also use an EIN to hire employees and open a business bank account.

- Trademark registration. Register trademarks, like your business name and logo design, that distinguish your unique business to the world. Pro tip: conduct a name search first to ensure the mark is available before filing a trademark application!