Rollovers for Business Start-ups (ROBS) lets you tap your retirement funds without early withdraw or tax penalties for financing your small business. With a quick turnaround and without interest or a risk collateralizing your home, you can get your business ready to launch as soon as the quarantine lifts – or even sooner.

*

Though the coronavirus pandemic has created unprecedented change and challenge across the country and the world, like many other difficult situations throughout history, it’s also created opportunity. Historically, when the unemployment rate rises so does the number of new small businesses. Many aspiring entrepreneurs do not want to build dreams for others without control over their own fate. They want to become their own boss and pursue their own passion.

Creating your own job with small business ownership is a fantastic way to empower yourself in tough times. Entrepreneurship turns a stressful situation into a fresh start.

Since getting your small business started can take a few weeks to a few months, getting started during quarantine actually puts you a step ahead. You can take action right now to get your doors open as soon as the quarantine lifts.

What about funding? When we see the Small Business Administration (SBA) and banks overwhelmed, funding your small business may seem out of reach. It’s not. You might already have the money you need thanks to Rollovers for Business Start-Ups (ROBS).

What is Rollovers for Business Start-Ups (ROBS)?

Rollovers for Business Start-ups (ROBS) is also known as 401(k) business financing. ROBS is a lesser-known form of small business financing that’s actually been around for decades. In 1974, Congress passed the Employee Retirement Income Securities Act (ERISA). This works with sections of the Internal Revenue Code (IRC) to let you use your eligible retirement funds to start a business without early withdraw fees or tax penalties.

Guidant estimates about 81 percent of our ROBS clients are still operating after four years or have successfully sold their business. The average is about 39 percent. The benefits of ROBS help you get your business off on a firm footing, setting you up for long-term success.

Why ROBS?

Rollovers for Business Start-ups come with advantages that are particularly notable during the coronavirus pandemic. Banks and the SBA are overwhelmed right now, with businesses requesting additional funding and new loans. The SBA is scrutinizing certain business industries, potentially unwilling to loan out funds for months. However, with ROBS you don’t have to depend on someone else telling you if you’re allowed to have the cash you need to start your business. You’re investing in yourself.

Leverage Retirement Funds Tax Penalty-Free

Typically, if you decide to pull from your pre-tax retirement funds, you’re hit with hefty tax penalties, plus an early withdrawal fee of 10 percent for those younger than 59-years-old. ROBS is one of the few methods that let you use retirement funds without incurring tax penalties or other fees. In conclusion, this allows you to put more of your money to work for you.

Start a Business Without Debt Payments

Traditional funding solutions like bank loans are forms of debt-based financing that require monthly interest payments. ROBS isn’t a loan. There are no payments to make, and no interest incurred. Therefore, this lets you make a profit faster and put money into their business that would otherwise go to payments.

Invest in Yourself, Not the Stock Market

Traditional retirement accounts are usually invested in common stocks, bonds, and mutual funds known for their return on investment. But, if you want to put your money to work and invest in your own dreams, ROBS lets you do so and grow your nest egg. With ROBS, you don’t have to rely on the volatile stock market. This is an investment you have complete control over.

No Credit Score Requirements

Since ROBS isn’t a loan, your credit score isn’t taken into account. Plus, there isn’t a lengthy application processes that usually accompany traditional financing methods. If you have at least $50,000 in a pre-tax retirement account and the funds are rollable, you’re eligible for ROBS.

Tax Benefits

C Corporations benefited under the 2018 tax reform. Profits under a C Corp are taxed at a flat 21 percent (down from the previous 35 percent rate) no matter how much revenue is generated. Profits from the corporation don’t pass through to the business owner, so there’s no effect on your tax bracket.

How does ROBS Work?

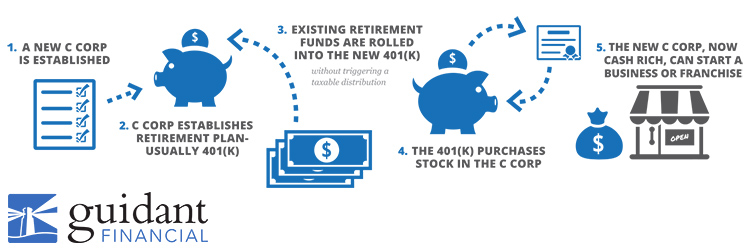

Rollover for Business Start-ups works by rolling funds from your existing and eligible retirement account (like an IRA or 401(k)) into a new 401(k) account. This is sponsored by the new company being funded. The new 401(k) plan then purchases stock in the private corporation being funded through a transaction called Qualified Employer Securities (QES). For example, think of buying shares of Microsoft or Amazon stock, except not on the public market.

Step 1: Set Up a New C Corporation: As required by the IRS, all companies funded with ROBS have to be C Corporations. Guidant partners with MyCorporation to help you form a C Corporation, thanks to MyCorp’s experience and efficient process.

Step 2: Establish a New 401(k) Plan: A new 401(k) plan is established on behalf of the new C Corporation. You become the trustee and 401(k) plan administrator. This might sound intimidating, but it’s not. Most ROBS providers like Guidant offer 401(k) plan administration services to do the hard part for you.

Step 3: Roll Retirement Funds Into the New 401(k) Plan: Funds are rolled from the existing retirement account into the new 401(k) account. This step is the ‘rollover’ in Rollovers for Business Start-ups (ROBS).

Step 4: The Stock Purchase: The 401(k) plan purchases private stock in the C Corporation. This is done through a Qualified Employer Security (QES) transaction.

Step 5: Your Business is Cash-Rich: Thanks to the stock purchase, the C Corporation (your business) is now cash-rich. Your funds can be used for lots of things. For example, you may launch a new business, buy an existing business, buy or build out a retail space, order equipment, and more. If you need more money, you can use your ROBS funding as a down payment on a business loan.

What’s a ROBS Provider?

A ROBS provider is a firm that helps you set up your ROBS transaction. Most of the time, ROBS providers will also handle the 401(k) plan administration for you. At Guidant, this means keeping your 401(k) plan and business in compliance with the Department of Labor (DOL) and IRS.

At Guidant, we’ve helped over 20,000 small businesses get started, so we understand ROBS. While all ROBS providers have their own process, here’s how it works with us.

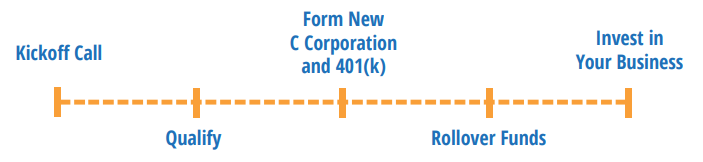

We start with a kickoff call with one of our expert business financing consultants who can help you decide if ROBS is the right fit for you. If it’s not, they’ll walk you through other available funding options. Once we’ve ensured ROBS is right for you, our team will work with you to provide everything you need for the funding process, from paperwork to time with an Outside Counsel who makes sure all the I’s are dotted, and T’s are crossed.

After that, we’re here for you through the life of your business to help make sure your plan and company are compliant with DOL and IRS rules and regulations.

Looking Ahead With ROBS

Though we’re living in an uncertain world right now, that doesn’t mean life has to stop. You can still follow your dreams, take control of your life, and create your own job. Above all, instead of waiting for change, you can make it happen.

Guidant Financial helps business owners secure financing to start, buy, or grow a business. An industry leader in business and franchise financing, Guidant works with new and existing entrepreneurs to identify, evaluate, and deploy customized financing solutions. Their services include, but are not limited to, 401(k) business funding, SBA loans, unsecured credit, and portfolio loans. In total, Guidant has helped over 20,000 entrepreneurs in all 50 states to invest more than $4 billion in funds to start small businesses, resulting in more than 85,000 U.S. jobs created. Visit Guidant at guidantfinancial.com.