Is it time for your small business to elect an S Corp filing?

Several factors go into the decision-making process when picking an entity for a small business. The entity formation needs to be a fit for the business’ tax and legal purposes. Generally, many new entrepreneurs choose to incorporate as a sole proprietorship. This default entity formation is often the easiest to file. There is little paperwork and affordable filing fees that encourage entrepreneurs to initially form a sole proprietorship.

However, a sole proprietorship is also heavy on taxes. Unlike an S Corporation, which allows income, deductions, credits, and losses to pass-through to business owners, sole proprietors are responsible for all taxable activity. Sole proprietors must report all income on tax returns, including self-employment tax and tax on all business profits.

Essentially, this means a sole proprietor pays personal and business tax on their income. If you incorporate as a sole proprietor, you may be reeling at the tax amount that you must pay.

Luckily, there is way to start lowering your tax bill now. MyCorporation’s S Corporation Tax Calculator makes a visible difference for the bottom line of your taxes. Here’s how it works and how an S Corp filing can benefit your small business.

Saving Money with an S Corporation Filing

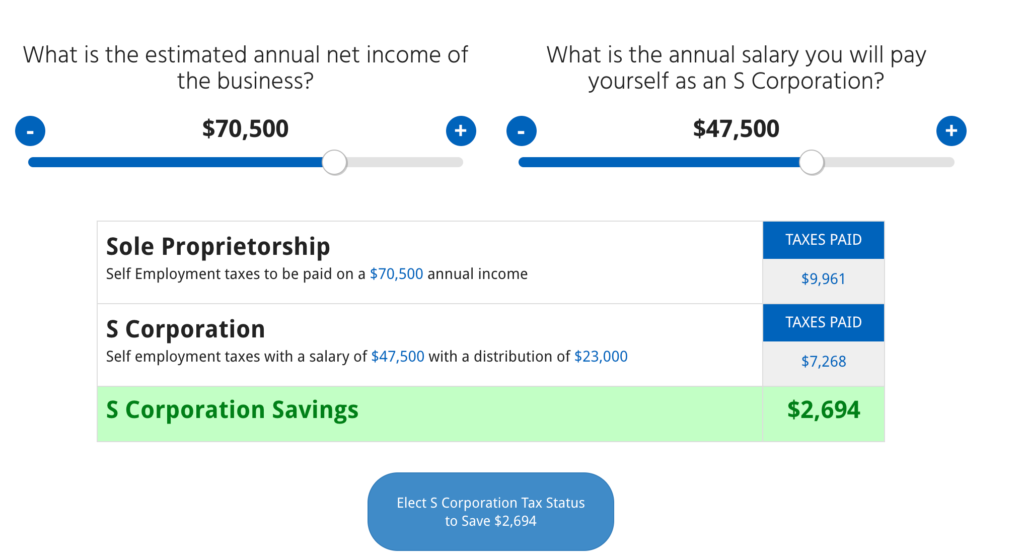

Start lowering your tax bill with the help of MyCorporation’s S Corporation Tax Calculator. In just a few, quick steps you’ll discover tax savings available with an S Corp filing.

- Enter your estimate annual business net income.

- Enter the annual salary you will pay yourself as an S Corporation. You may estimate this number with the help of salary platforms like Glassdoor.

As you enter in the numbers, you’ll see immediate savings.

S Corporation Savings Example

Let’s say the estimate annual net income of your small business in $70,500. You decide to pay yourself a reasonable salary of $47,500.

If you remain a sole proprietor, you will need to pay $9,961 in self-employment taxes. That’s a tax payment of almost $10,000! However, if you elect an S Corp you will pay $7,268. That’s $2,694 in tax savings by opting for a S Corp filing.

Additional Benefits of an S Corp Filing

You were able to use MyCorporation’s S Corporation Tax Calculator and explore tax savings. What other financial savings can small businesses receive from an S Corp filing? Let’s take a look at other opportunities where S Corps help save money.

- Pass-through taxes. An S Corp is a corporation with a pass-through entity. As mentioned above, this means corporate income, losses, deductions, and credits pass through to shareholders. The shareholders report taxable activity of the company on their personal income tax returns. In short, this allows an S Corp to legally avoid double taxation.

- Reduced self-employment tax liabilities. Self-employment taxes can quickly become expensive, especially for sole proprietors. An S Corp allows its shareholders to act as employees. The shareholders, now employees, receive a salary and dividends. This helps reduce self-employment taxes and the total annual tax liability.

- Salary write-offs. Shareholders of an S Corp may draw a salary from the business profits. After that, these taxes are taken directly out of your paycheck. The S Corp then pays for half of the FICA payroll taxes throughout the year. As a result, shareholders that are able to write off their salary may lower their portion of payroll taxes.

- Limited liability protection. Much like forming an LLC, an S Corp filing provides entrepreneurs with limited liability protection. This ensures the personal assets of the business owners are separate from those of the business. These assets receive limited liability as protection.

Are You Eligible for an S Corp?

Before we move on to share how to start an S Corp filing, it’s important to determine if your small business is eligible. Here are a few eligibility guidelines for S Corporations.

- The business must be a domestic corporation.

- The business must have a designated registered agent.

- No more than 100 shareholders can be within the business.

- Shareholders must be individual persons.

- The business must have a single class of stock.

- The business may not be an ineligible corporation.

Ready to File an S Corp Election?

Did our S Corporation Tax Calculator tool encourage you to elect an S Corporation?

In conclusion, it may be time to review your business status. Choosing an S Corp filing may be financially advantageous to your business. Above all, an S Corporation helps small businesses save money on taxes and receive additional financial benefits.

MyCorporation’s team of professionals can help you start an S Corp filing today. Contact us at mycorporation.com or call us at 1-877-692-6772.